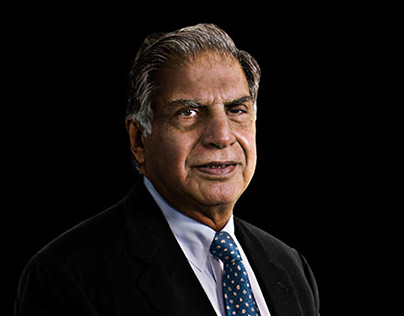

The recent passing of Ratan Tata, one of India’s most iconic business leaders, has left a leadership void at Tata Trusts, the philanthropic foundation that steers the $165-billion Tata Group. This has prompted discussions about succession planning not only in the corporate world but also for individuals managing their personal estates. The Tata family, renowned for its business acumen and values, has long relied on trusts to ensure the stability and longevity of its empire. However, Ratan Tata reportedly did not name a direct successor before his passing, leaving the board of trustees to make crucial decisions.

In this article, we will explore the differences between wills and trusts and why it’s important to consider both when planning the future of your assets, inspired by the legacy of Ratan Tata.

Understanding Wills: A Basic Estate Planning Tool

A will is a legal document that outlines how your assets—ranging from real estate to personal belongings—will be distributed after your death. It ensures that your wishes are respected and that the people or causes you care about receive the portions of your estate that you intend to leave behind. Ratan Tata‘s estate planning choices offer valuable insights here. A will typically names an executor responsible for overseeing the distribution process, handling debts, and ensuring everything is carried out according to your instructions.

However, while a will can be a straightforward way to pass on your assets, it has certain limitations. For instance, it often goes through probate—a legal process where the court supervises the distribution of assets. This can take time, add costs, and make your estate matters public, something Ratan Tata may have avoided by relying more on trusts.

Trusts: A More Flexible and Private Option

On the other hand, a trust offers more flexibility and control over how your assets are managed and distributed. A trust is essentially a legal entity that holds your assets and outlines how and when these assets will be passed on to your beneficiaries. Ratan Tata and his family’s reliance on trusts has allowed for smoother transitions and effective management of their vast empire. Unlike a will, trusts can be set up to operate during your lifetime, giving you greater flexibility.

One of the biggest advantages of a trust is that it can help avoid probate, keeping your estate matters private and allowing for faster, more efficient distribution of assets. Additionally, trusts allow for complex planning, such as setting conditions on when beneficiaries receive their inheritance or providing for individuals with special needs. Trusts also help minimize taxes and protect assets from creditors or lawsuits—benefits that Ratan Tata and his family have undoubtedly leveraged.

The Tata family, for instance, used trusts to manage a significant portion of their assets, ensuring the preservation of the group’s legacy and supporting philanthropic activities. This approach mirrors Ratan Tata’s values, ensuring that leadership transitions happen smoothly, and the values of the Tata Group continue to thrive across generations.

Succession Planning: A Key Lesson from Ratan Tata

The situation surrounding Ratan Tata‘s passing underscores the need for comprehensive succession planning. Despite his immense success in leading the Tata Group, the absence of a named successor for Tata Trusts has left the board of trustees to decide on future leadership. This situation highlights the risks involved when a leader does not formalize a succession plan.

For individuals, whether you own a business or have personal assets to pass on, the decision between using a will, a trust, or both should not be taken lightly. Ratan Tata’s choices provide valuable lessons here. While a will might be sufficient for simpler estates, a trust offers more tailored and secure management, especially for complex estates.

Will or Trust: What’s Right for You?

When deciding between a will, a trust, or both, several factors must be considered, as Ratan Tata‘s case illustrates:

- Estate size: Larger estates, like that of Ratan Tata, may benefit more from trusts due to their flexibility and control.

- Privacy: If privacy is a concern, as it was for Ratan Tata, a trust helps avoid public probate proceedings.

- Complexity: Trusts allow for more complex planning, which is crucial for large estates like Ratan Tata‘s.

- Taxes: Trusts often offer more favorable tax advantages, which can be crucial in estates the size of Ratan Tata‘s.

Conclusion: Planning for a Seamless Transition

Whether you’re managing a large empire like Ratan Tata or ensuring your personal estate transitions smoothly, succession planning is key. A well-structured plan—whether it involves a will, a trust, or both—helps secure your legacy, much like the one Ratan Tata built for the Tata Group.